Professional Support: Bagley Risk Management Approaches

Wiki Article

Understanding Animals Risk Defense (LRP) Insurance: A Comprehensive Overview

Navigating the world of livestock risk defense (LRP) insurance can be an intricate venture for numerous in the farming field. This sort of insurance coverage provides a security internet against market variations and unanticipated circumstances that might impact animals producers. By understanding the complexities of LRP insurance, producers can make enlightened decisions that may secure their operations from economic threats. From exactly how LRP insurance coverage works to the numerous insurance coverage alternatives readily available, there is much to discover in this thorough overview that could potentially form the way livestock manufacturers come close to threat management in their companies.

Just How LRP Insurance Policy Functions

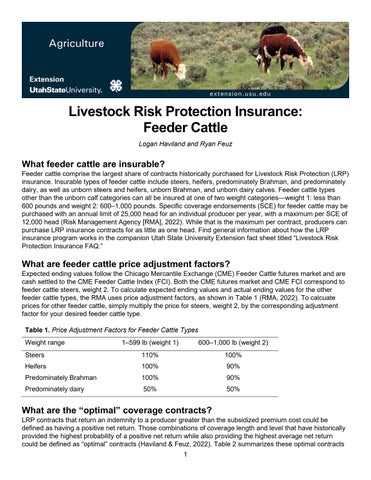

Periodically, recognizing the mechanics of Livestock Danger Security (LRP) insurance policy can be complex, yet damaging down just how it works can provide quality for herdsmans and farmers. LRP insurance coverage is a risk monitoring tool designed to protect animals manufacturers versus unanticipated cost declines. The policy allows manufacturers to set an insurance coverage level based upon their certain needs, selecting the variety of head, weight range, and insurance coverage price. When the plan is in location, if market value fall listed below the coverage price, manufacturers can sue for the distinction. It is necessary to note that LRP insurance is not a profits guarantee; instead, it concentrates only on cost threat protection. The insurance coverage period usually varies from 13 to 52 weeks, providing flexibility for producers to pick a duration that aligns with their manufacturing cycle. By utilizing LRP insurance policy, breeders and farmers can reduce the monetary threats related to varying market value, guaranteeing higher stability in their procedures.Eligibility and Coverage Options

When it comes to protection choices, LRP insurance coverage uses producers the adaptability to choose the insurance coverage degree, insurance coverage period, and endorsements that ideal match their danger administration requirements. By understanding the eligibility standards and insurance coverage options readily available, livestock manufacturers can make educated decisions to handle risk successfully.

Advantages And Disadvantages of LRP Insurance Coverage

When examining Animals Danger Protection (LRP) insurance policy, it is crucial for animals producers to weigh the drawbacks and benefits intrinsic in this risk monitoring tool.

One of the key benefits of LRP insurance coverage is its capacity to give protection against a decrease in animals rates. Additionally, LRP insurance provides a level of versatility, enabling producers to personalize protection degrees and plan periods to match their details demands.

Nonetheless, there are likewise some drawbacks to think about. One limitation of LRP insurance policy is that it does not secure against all sorts of risks, such as condition episodes or all-natural catastrophes. Premiums can sometimes be costly, especially for producers with huge animals herds. It is vital Full Article for producers to thoroughly analyze their private risk direct exposure and economic circumstance to figure out if LRP insurance coverage is the right threat administration tool for their procedure.

Recognizing LRP Insurance Premiums

Tips for Optimizing LRP Benefits

Taking full advantage of the advantages article source of Animals Danger Defense (LRP) insurance policy needs calculated preparation and positive danger administration - Bagley Risk Management. To maximize your LRP coverage, think about the adhering to suggestions:Consistently Assess Market Conditions: Stay notified concerning market fads and rate variations in the animals sector. By keeping track of these elements, you can make informed decisions about when to acquire LRP coverage to secure against potential losses.

Set Realistic Protection Levels: When selecting coverage degrees, consider your manufacturing expenses, market worth of livestock, and potential risks - Bagley Risk Management. Establishing practical insurance coverage degrees makes sure that you are adequately protected without paying too much for unneeded insurance coverage

Diversify Your Coverage: Rather of depending exclusively on LRP insurance policy, think about diversifying your threat management approaches. Combining LRP with various other danger management tools such as futures contracts or options can offer extensive coverage versus market uncertainties.

Review and Change Coverage Frequently: As market conditions alter, periodically assess your LRP protection to guarantee it lines up with your existing danger exposure. Changing insurance coverage levels and timing of acquisitions can help maximize your threat protection strategy. By following these pointers, you can make best use of the benefits of LRP insurance and secure your animals procedure versus unanticipated risks.

Verdict

In conclusion, livestock risk security (LRP) insurance policy is a beneficial tool for farmers to handle the economic risks linked with their livestock operations. By comprehending exactly how LRP functions, qualification and insurance coverage alternatives, along with the benefits and drawbacks of this insurance, farmers can make educated choices to shield their incomes. By very carefully considering LRP premiums and executing techniques to take full advantage of benefits, farmers can minimize potential losses and make sure the sustainability of their operations.

Animals manufacturers interested in getting Animals Danger Defense (LRP) insurance can discover a range of eligibility criteria and protection choices tailored to their certain animals operations.When it comes to protection web choices, LRP insurance coverage uses producers the versatility to select the protection level, coverage period, and recommendations that ideal match their danger monitoring needs.To comprehend the intricacies of Livestock Threat Defense (LRP) insurance policy totally, recognizing the variables affecting LRP insurance coverage premiums is vital. LRP insurance coverage premiums are determined by different elements, consisting of the protection degree picked, the expected cost of livestock at the end of the insurance coverage period, the type of animals being insured, and the length of the insurance coverage period.Review and Readjust Coverage Frequently: As market conditions transform, regularly review your LRP insurance coverage to ensure it aligns with your existing danger exposure.

Report this wiki page